The Current Investor’s Dilemma

We get it. Investing can be a daunting task. Until recently the average investor’s options have been extremely limited. Lets take a look at the current and standard options for investor Joe.

In traditional circles, investment options proposed by most Investment Advisors are typically limited to bonds, and treasuries or bank certificates. Otherwise investor Joe gets offered to place his funds with professional “stock pickers” (i.e. mutual funds, unit trusts etc…) who try their hardest to beat the market. Granted there are always opportunities for profit here, the proven reality is that unfortunately most of these funds actually fail to consistently beat the market.

!

It turns out there

ARE some viable other options!

Alternative Investments – A New Flavor!

For the growing number of Investor Joe’s (and Josephine’s) out there who are fed up with the lack of options, or who are getting tired of watching their investment accounts gather dust, we are happy to tell you, that the current investment landscape is not all doom and gloom anymore, and it is rapidly changing these days. Thus, there are some attractive options available now. Welcome Alternative Investing!

Simply put, this asset class is comprised of non-traditional investments. This can be chalk full of interesting and exciting options, many of which people are very passionate about such as fine wine, rare art, music, sports industries, technology, precious metals, gemstones, patents, stamps, start-ups, agriculture, even rare gun collections and exotic car collections. On the flip side, it can also include sophisticated and extremely complex financially engineered products such as derivatives, hedge fund strategies, private equity, leveraged real estate, and debt instrument trading.

The problem with this asset class is that unlike the traditional ones, there are sooo many options to choose from that investors get lost easily, or they simply do not have the experience or ability to gain access to the highest quality ones. This often leaves one with the feeling of “paralysis by analysis”.

Thus, we believe the key to success in this industry

is linked to adopting 3 key proven principals:

Specialization

One must invest with a specialist in their specific niche. This isn’t a place for a “jack of all trades”. In our case, (spoiler alert – if our name didn’t give it away) we specialize solely in Institutional Grade Managed Forex Trading. We almost obsessively live, eat, breath and sleep it.

Technology

Using new technologies is critical to success (this is especially true in the financial markets). In our case we use computer programs to trade the market for us. Further, we use game changing technology to protect our capital, manage our risk, customize our risk, and tailor it to individual’s unique and changing needs – investing is not “one size fits all”.

Simplification

It doesn’t need to be complex – really! And it shouldn’t be. Alternative investing needs to be accessible, transparent, and easy to participate in. It need not be measured by its degree of complexity, (sometimes “less is more”). This is why we choose Managed Forex Trading as our ideal investment!

Why Our Funds?

Our unique programs have been meticulously researched, analyzed and stress-tested, and have proven to shine in their ability to profit in virtually ANY economic environment. Time after time, the successful growth of this investment class in general has proven to thrive regardless of conditions such as a strong economy, low inflation, high interest rates, or a bloated or depressed stock market. While our funds are no panacea to endless profits, we strongly feel we obtain an even further edge by sticking to our key investment formula and always staying true to our Company’s Core Investment Strategy.

Often Over-Looked Benefits Of Managed Forex

- They diversify an investment portfolio very well, while reducing its volatility

This is due to much lower correlations to more traditional asset classes and markets. - They have an “Absolute Return Mandate”

This means they are designed at the core, to profit in virtually all market environments and conditions. - They capitalize on opportunities not offered in the general public markets.

This is simply due to less market constraints and more opportunity/creativity.

The Optimal Combination of Risk and Return

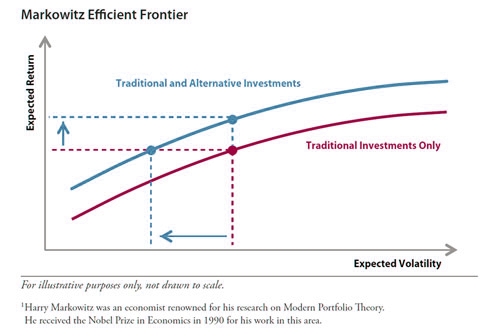

This chart illustrates something called the Markowitz Efficient Frontier. It represents all portfolios with the best risk-adjusted rates of return (as measured by volatility). We can see that the inclusion of alternative investments can move the efficient frontier up and to the left. What does this mean exactly? It means that by adding quality alternatives to ones portfolio like our Managed Forex Accounts, that for a given level of return, risk is lower, or for a given level of risk, return is higher – creating the optimal combination of risk and return!

Socially Responsible Investing

Have you ever wanted a way to feel good about your investments both morally AND financially?